GM. It’s The ReFi Brief on a Saturday. Tokenized real estate news explained in simple terms, so anyone can understand and explore how tokenized ownership works and why it matters.

In this week’s ReFi Brief:

Eric Trump Tokenizes Real Estate via World Liberty Financial (WLFI)

U.S. SEC Embraces Tokenization

BlackRock CEO: Tokenization as Finance’s “Next Wave of Opportunity”

Japan’s MIRAI-X Platform Unlocks $5.7B “Trophy” Property Onchain Deal via Blockchain

This week was about momentum meeting legitimacy, with the SEC opening the rulebook, BlackRock building rails, and Trump testing retail access. Think of it as tokenization stepping out of the lab and into the marketplace, where the experiment phase may just be about to give way to real adoption.

THE BIG READ

Eric Trump’s WLFI plan opens $1K access to Trump real estate, but is it really for everyone? (P1)

So, Eric Trump says he’s done waiting on banks. He’s bent on taking Trump-branded real estate on-chain, and opening access to just about anyone with at least $1,000.

Question….can crypto really turn luxury property into a people’s investment?

This one had me curious this past week.

What happened?

Eric Trump confirmed this past week via CoinDesk that his venture, World Liberty Financial (WLFI), is building a tokenized real-estate deal around a property in development.

The pitch: bypass Wall Street, let everyday investors buy micro-shares, and fund the project directly through blockchain rails and WLFI’s own stablecoin, USD1.

“Why can’t I go out to the masses?”

That’s the question Trump himself posed, and it captures the mood. If he can raise money directly from supporters instead of Deutsche Bank, he gets both financing and fandom.

And for the first time, small investors could get a stake, even perks like hotel stays in a Trump building.

Can I really get into a Trump deal for $1K?

Traditionally, buying into a Trump-level property meant six-figure checks, accreditation letters, and handshakes with private-equity firms.

WLFI flips that script. It’s pitching tokenized entry points that feel more like Kickstarter for real estate, smaller buy-ins, global reach, and instant digital proof of ownership.

The minimum ticket? About $1,000, nearly fifty times lower than what private-equity investors usually need to put on the table.

But what will I actually be buying?

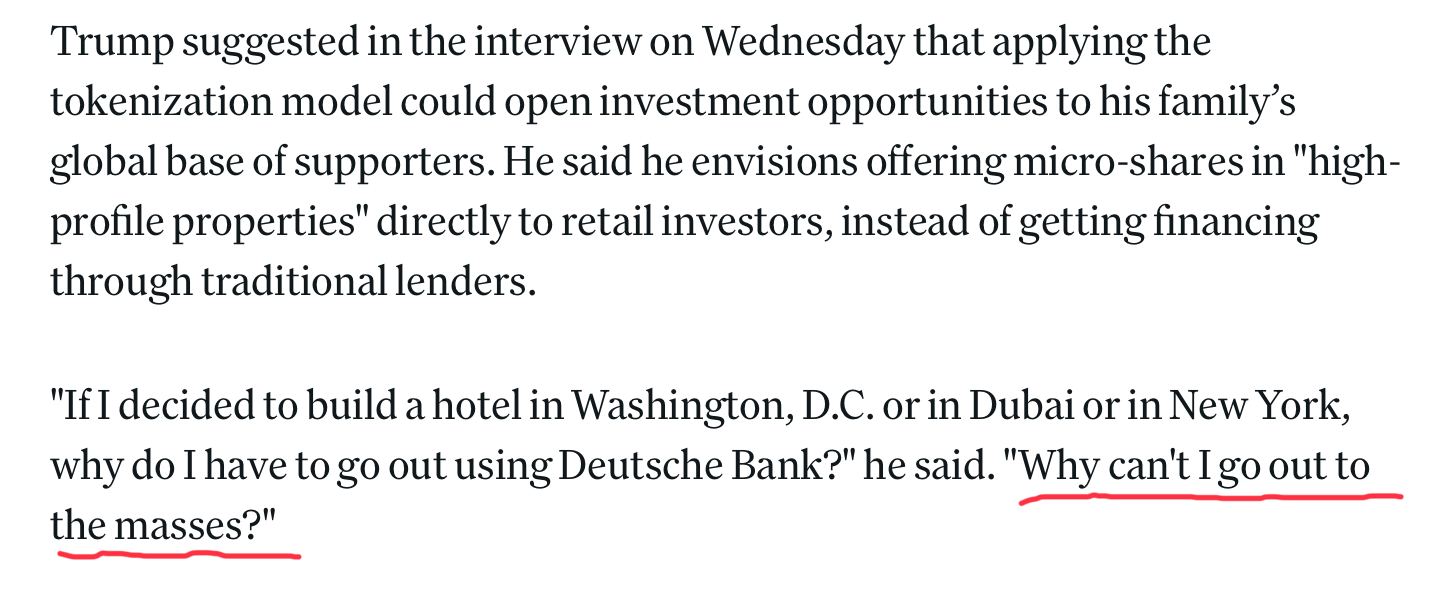

Each token would represent a fraction of a building under development, the “slice” model.

Image Source: Tokeny

Think of it as buying one Lego block of a skyscraper instead of the whole thing. Your $1,000 doesn’t actually buy you a room, but a digital claim to part of the project’s profit and perks.

So how would it actually work?

It’s meant to feel simple:

Sign up. You’d open an account on WLFI or a partner app. Basic ID checks are likely.

Add funds. You deposit cash or crypto, which converts into WLFI’s USD1 stablecoin.

Buy your slice. Those funds buy digital tokens tied to the property itself.

Hold it. Your tokens live in a wallet, either one you control or inside WLFI’s upcoming debit-card app.

Earn later. When the building’s finished, any profits or perks would flow back to you, probably paid in USD1.

Access looks easy on paper. But compliance and liquidity could decide if this is truly open or just open-ish.

So what’s the catch?

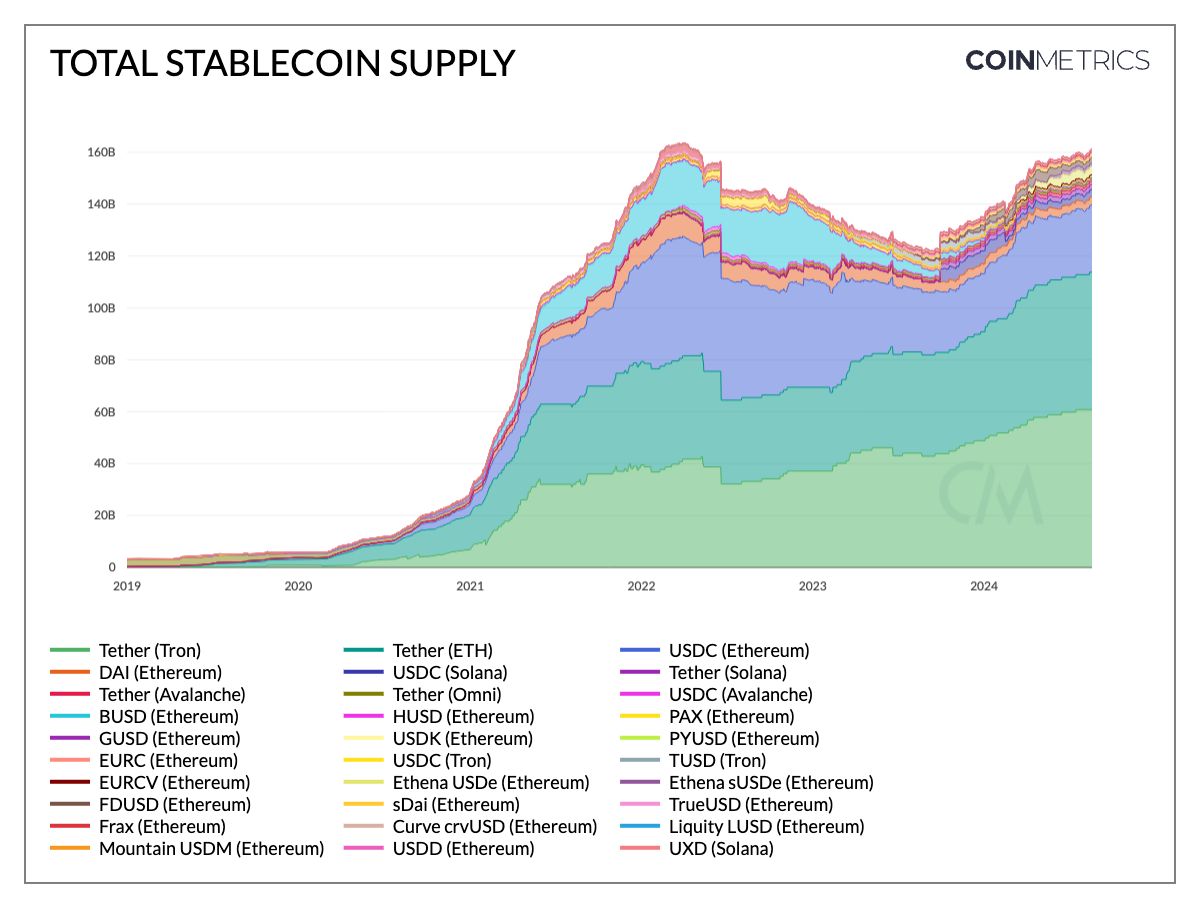

USD1, the stablecoin anchoring this, hasn’t published a reserve attestation since July 2025, despite a $2.7 billion supply. Without that proof, it’s hard to verify what backs the system that would handle all investor money.

NYDIG analysts call such transparency “non-negotiable.” And they have spoken directly about WLFI Stablecoins needing “better attestation reports”.

Source: Coinmetrics

Access sounds thrilling. But if the rails (USD1 + WLFI) aren’t transparent, is this doorway safe to walk through? Can a populist property sale run on opaque rails?

Coffee Chat

Where does my money actually go when I buy a token?

When you buy a token, your money goes into the legal entity that owns the real property, usually a company or trust set up just for that building. That entity then issues tokens to represent shares in the project.

So you’re not sending funds into the void or betting on crypto hype. You’re investing in a structure that exists in the real world, with ownership and value linked to an actual asset.

The token is simply your digital proof, a record that says you own a slice of something solid, not just a string of code.

Eric Trump’s WLFI plan opens $1K access to Trump real estate, but is it really for everyone? (P2)

So what’s verified so far?

A real building under development.

WLFI’s rails exist, they’re already live for USD1 transactions.

Public statements of intent to let retail investors in directly.

Everything else, structure, returns, regulation, sits in the Claimed or Unknown column.

Custody: who holds the keys?

Trump hinted users might control their own tokens, “true DeFi ethos.” That’s empowering but risky. Lose your private key and your “hotel slice” vanishes. WLFI’s app might default to custodial wallets, yet details are missing

Self-custody may sound like freedom, but for first-time investors it can be like managing your own vault without insurance.

Yield: cash or perks?

Early chatter mentions token-holder benefits: free stays, VIP access, or loyalty rewards. That’s a fun hybrid, financial stake plus fan club.

But there’s no proof of how or when actual profits flow. If the property is still being built, real yield = $0 until completion. These perks act more like coupons than dividends.

Liquidity: can you get your money back?

That’s the biggest open question. No marketplace or Alternative Trading System (ATS) has been announced. So until one exists, token holders are effectively locked in.

Analysts say early secondary sales, if they appear, could trade at deep discounts, think private-market patience, not Robinhood speed.

Tokenization doesn’t erase illiquidity; it just digitizes it.

Compliance: The SEC’s new rulebook is still being written

Fractional real estate tokens almost always fall under securities law, meaning WLFI would need an exemption like Reg A+ or Reg D to sell to the public. Under the previous SEC regime, that alone would have likely stopped the project cold.

But under new Chairman Paul Atkins, the SEC is shifting from enforcement to innovation, he’s made tokenization “job one” and hinted at a coming “innovation exemption” that could let compliant projects test offerings under oversight before full registration.

If WLFI files under today’s rules, it faces the old playbook. If it waits, it might benefit from the new one.

So in essence, WLFI know what’s ahead and are frontrunning; the U.S. wants to open tokenized access, but the rulebook is still being built as issuers start walking across it.

A bit of market context

Trump’s move joins a global rush.

In Japan and the UAE, platforms like MIRAI-X are tokenizing multi-billion-dollar luxury projects, targeting 8–12% yields. Banks from HSBC to JPMorgan are piloting tokenized funds.

So WLFI isn’t first, it’s probably the first to attach a household name and a populist spin.

Stablecoin risk

If USD1 were ever frozen or lost its peg, payouts could halt. That risk ties every investor’s return to WLFI’s ability to maintain dollar reserves and regulatory goodwill.

A “building on-chain” only works if the digital dollar beneath it holds.

The TRUMP factor

Brand gravity cuts both ways. On one side: instant visibility and a loyal investor base. On the other: political scrutiny, volatility, and valuation premiums that may not survive a market downturn.

Tokenization doesn’t neutralize brand risk, it amplifies it by turning sentiment into liquidity.

What to watch next

• WLFI’s regulatory filing or exemption notice.

• Updated USD1 reserve attestation (last one July 2025).

• Confirmation of minimum ticket and property location.

• Launch of a secondary market or redemption window.

Until those proofs appear, this is access-in-the-making, not yet access-in-practice.

Takeaway

Tokenization promises open doors to everyone, and we’re only seeing the first hinges move. The rails still need to prove they’re safe and legal, but the direction feels set.

Give it time, and that promise will eventually become the new normal.

TM

THE WEEK IN BRIEF

Image Source: Finbold

The Brief: Since taking office in April 2025, new SEC Chair Paul Atkins has re-cast crypto and tokenization as the agency’s top priority. He’s shifting from lawsuits to rule-making, even floating an “innovation exemption” to let compliant tokenized products launch under supervision instead of threat.

The Details:

Atkins said the SEC should be the “Securities and Innovation Commission.” That marks a turn from enforcement to collaboration — a green light for compliant tokenization.

He has withdrawn or paused multiple crypto cases and launched Project Crypto to modernize securities rules. This opens the door for tokenized RE funds and marketplaces to operate legally.

A planned “innovation sandbox” would let issuers test tokenized assets under clear disclosure rules — cutting costs and fear for startups.

Regulatory details are still pending; inter-agency coordination and durability of this policy are the big unknowns.

What This Means: If Atkins delivers, U.S. issuers could launch tokenized real estate without a million-dollar law budget. Investors get legal clarity instead of legal risk, turning “Is it safe?” into “Yes, under rules we can see.”

Image Source: Retail News Asia

The Brief: BlackRock chief Larry Fink declared tokenization the “next wave of opportunity” across finance. He says the world’s largest asset manager is already building tech to digitize funds and real estate, following its $2.8 B tokenized cash fund success.

The Details:

BlackRock is developing in-house blockchain rails to turn traditional funds into tokens tradable 24/7. That means fractional ownership and global reach.

Fink frames it as bridging $4.1 trillion in digital wallets into regulated products, a mass on-ramp for crypto capital into mainstream assets.

Tokenization could cut fees and raise net ROI, by removing brokers and paper settlements.

Regulators still must sign off on tokenized ETFs and funds, but BlackRock’s endorsement is the strongest signal yet that Wall Street sees this as inevitable.

What This Means: When a $13 trillion giant starts tokenizing funds, the rest of finance follows. Expect 24/7 liquidity and fractional entry points that make real estate and funds as easy to trade as stocks.

Image Source: Business Insider

The Brief: Tokyo-Dubai platform MIRAI-X has tokenized a $5.7 billion mixed-use development near the new Wynn Resort, using Stellar blockchain and smart-contract escrow to secure investor funds. It’s one of the largest tokenized real-estate projects yet.

The Details:

Investors can buy from $10 K per token into Fairmont Residences or Hotel projects targeting 8–12 % yields and 30–40 % appreciation.

Escrow contracts release capital only after verified construction milestones, a first for on-chain real estate safety.

Licensed under Dubai’s VARA and Abu Dhabi’s ADGM frameworks, it positions itself as a “trustless co-partner” for global investors.

Liquidity remains unproven; tokens may lock up until 2028–29 completions.

What This Means: MIRAI-X offers retail investors access to “trophy” assets with double-digit yields, but long timelines and liquidity risk make it a high-reward, high-patience bet on tokenized luxury real estate.

BRIEF X SIGNALS

🔗 Ondo Finance submits an open letter to the SEC, urging transparency on Nasdaq’s tokenized securities trading rules. For investors, this push for clear compliance details ensures a safer, legally sound way to invest in tokenized assets.

🔗 Blocksquare opens its Indexer codebase on GitHub, making tokenized property data verifiable in real time. This means investors can trust what they’re buying, with open access to compliance and ownership details.

🔗 ONINO’s Asset Financing Platform launches with a no-code interface and a completed security audit. For retail users, this offers a simple, compliant way to invest in tokenized real estate from small amounts, backed by verified safety.

🔗 Brickken’s CEO highlights regulatory compliance as the foundation for trust in tokenized assets, with major institutions shifting focus. This reassures investors that their investments are legal and secure, a key step toward confidence.

🔗 Deloitte predicts tokenized real estate could hit $4 trillion by 2035, growing at 27% annually. This growth promises investors increasing opportunities for steady yields from accessible property slices over time.

^

See you in the next brief,

Tatenda