GM. It’s The ReFi Brief. Tokenized real estate news explained in simple terms, so anyone can understand and explore how digital property ownership works and why it matters.

In this week’s ReFi Brief:

Tokinvest opens the gate to tokenized prime real estate

Fasset buys Pakistan’s DAO PropTech to scale $150 million in tokenised assets

DigiShares & BrickMark link U.S. and Europe for real-estate tokens

Hong Kong’s Desun buys into licensed broker to enter tokenization

India’s Landbitt brings land ownership onto blockchain

This week showed how regulated infrastructure is quietly catching up with tokenization’s promise. Licenses, mergers, and alliances are turning scattered experiments into global trading routes.

Think of it as property markets laying the cables for an internet of assets: legal first, liquid later.

THE BIG READ

Can tokenization really open elite property to the rest of us?

This week, something quite significant happened between Dubai and the UK, signalling how the future of property ownership continues to take shape at an increasing pace.

It sounds like this: fractionalize premium real estate so people can “invest like the 1%” but with far smaller entry tickets.

If that sounds like another marketing line, it isn’t. This is EXACTLY what tokenization of real world assets is all about.

Let me guide you through it.

What happened

Tokinvest, a licensed tokenization platform under Dubai’s Virtual Assets Regulatory Authority (VARA), partnered with API Global, a UK-based developer with more than $2 billion in high-end property deals.

Source: Tokeninvest

The pitch is simple: the assets are real, the rights are digital.

Why a deal like this matters

Real estate has always been the asset class of the wealthy. Minimums run in the hundreds of thousands, paperwork drags for weeks, and exit options are limited.

Tokinvest changes that by letting investors buy in with a few hundred dollars.

Scott Thiel, Tokinvest’s CEO, put it bluntly: “We’re opening up access so more people can invest like the 1%, in the same world-class assets, but with far lower barriers to entry.”

What is the significance of VARA and API Global

Tokinvest holds a VARA Issuer and Broker-Dealer license, one of the few in Dubai that allows real-world assets to be issued and traded as digital tokens.

Put this together with Tokinvest recently (September, 2025) raising $3.2 million in pre-seed funding to scale operations and you have project on moving rails.

API Global brings the inventory: prime apartments, branded residences, and investment-grade developments that would normally be out of reach for retail investors.

What will I actually be buying?

Each property deal is tokenized through a regulated issuance process. The SPV or trustee holds title to the property, and investors hold fractional tokens tied to that vehicle.

Think of it as owning a mini-REIT built around a single property.

Tokinvest’s statement describes “virtual tokens representing rights to assets, from ideation to trading to asset servicing.” That implies a closed, fully managed system: they mint the tokens, manage investor records, distribute income, and handle any secondary trades.

You’re not holding a deed. You’re holding a verified claim on a digital registry, backed by a real asset that Tokinvest manages under license.

Does it earn yield?

That depends on the asset type. If the property produces rental income, token holders receive dividends or profit-share via the platform, probably in fiat or stablecoin.

Michael Leighton of API Global said the venture targets “property investments that offer yield, liquidity, and transparency… within a fully regulated framework.”

In practical terms, yields on prime real estate tend to sit around 3 - 5 percent annually. The rest of the return depends on appreciation, how much the property value grows before it’s sold.

Tokinvest’s marketing highlights “high-performing property assets,” suggesting they aim for roughly 6 - 8 percent total annual returns, similar to listed REIT indices.

That’s competitive if achieved, but without live deals yet, those numbers remain theoretical.

Can I get my money back when I need it?

That’s the biggest open question.

Tokinvest says tokens can be traded “from ideation to asset servicing,” hinting at an internal bulletin board or secondary venue. But no active marketplace has been shown yet.

Until that exists, liquidity will depend on finding another buyer within Tokinvest’s network. Early investors could be locked in until the property is sold, meaning these tokens behave more like private real-estate shares than public securities.

It’s a credible compliance story but an unproven liquidity story.

How would investing actually work?

You’d sign up on Tokinvest’s platform, complete KYC under VARA rules, and fund your wallet, likely by bank transfer or stablecoin.

You’d then browse offerings sourced by API Global and buy fractional tokens directly on Tokinvest’s marketplace. The platform acts as the broker-dealer and digital transfer agent, recording who owns what on its ledger.

Income distributions would appear in your account as periodic payouts, while exit options would depend on either a buy-sell match inside the platform or a final property sale.

In short, the process should feel like investing through a regular crowdfunding portal, except the shares live on a blockchain under a VARA license.

Who can actually invest?

Tokinvest says “all investors globally.” That’s optimistic and my dream scenario.

Dubai’s VARA license covers local and cross-border offerings, but securities laws in places like the U.S. or EU might still limit retail participation.

So access will likely vary by jurisdiction.

Still, for investors in the Middle East, Asia, and potentially parts of Europe, Tokinvest’s regulatory setup potentially makes entry easier than in most Western markets.

The bigger picture

The timing of this partnership fits a larger shift.

According to Deloitte, $4 trillion of real estate could be tokenized by 2035, up from less than $0.3 trillion in 2024. That’s a thirteen-fold expansion in little more than a decade.

Platforms like Tokinvest are racing to capture the first wave of that market, especially in hubs like Dubai, where regulators have built clear licensing paths for virtual-asset issuers.

API Global’s presence adds credibility: it has sourced 5000+ developments for over 5000 clients across 40 markets, meaning Tokinvest won’t need to hunt for inventory.

Source: API Global

If this deal’s pipeline materializes as it should, the platform becomes a gateway for retail investors into institutional-grade property.

Two signals to watch for next

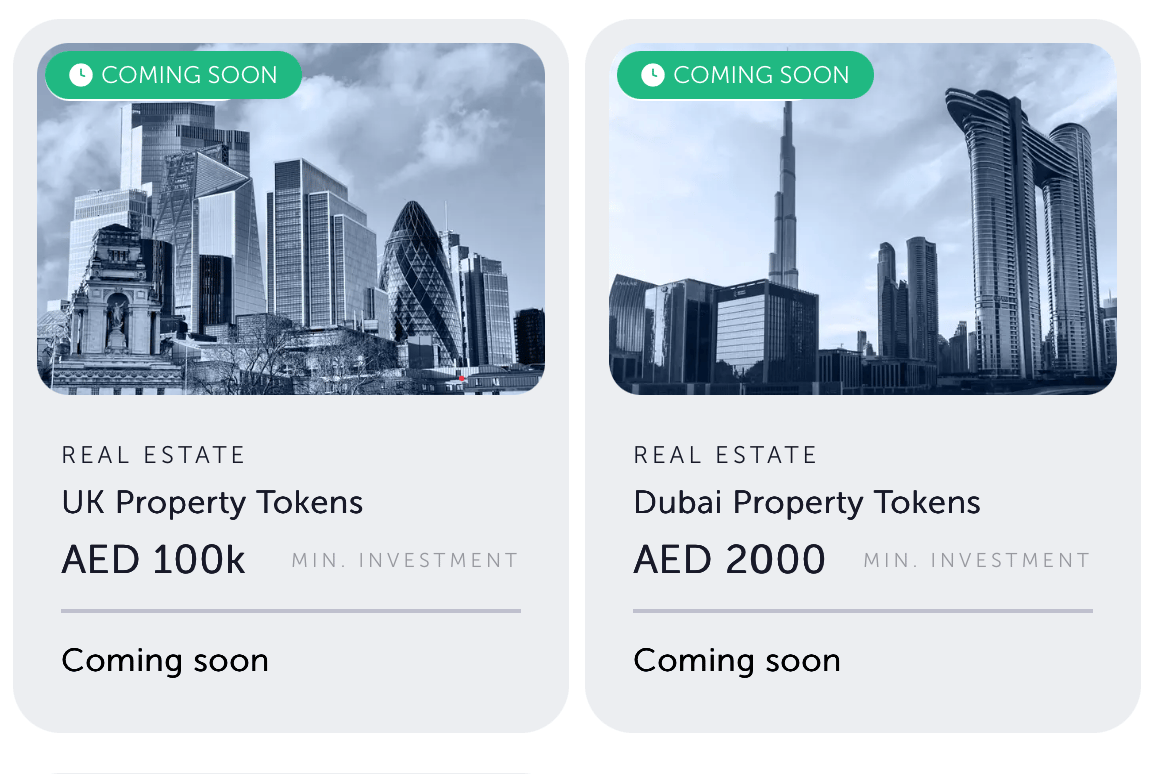

First, the launch of its first tokenized properties (currently shown as coming soon). A sold-out offering with steady payouts would validate its access and compliance claims.

Source: Tokeinvest

Second, the appearance of a functioning secondary market. Even limited trading volume would show that liquidity is possible, not just promised.

Takeaway

Tokinvest’s VARA license gives it regulatory credibility that most tokenized platforms lack. API Global gives it real assets to tokenize.

The concept, fractional access to elite property through compliant digital tokens is sound. The execution will decide if it becomes the retail gateway it promises.

Enjoy the weekend,

TM

Coffee Chat

How exactly does tokenization turn physical property into digital assets?

Lets start with a building.

Normally, ownership would sit on paper inside a government registry, changing hands slowly through lawyers and notaries.

Tokenization rebuilds that system in digital form. The owner places the property into a legal wrapper, usually an LLC or SPV, that holds the title.

That entity then issues tokens that represent slices of ownership or claims on rental income. Each token is recorded on a blockchain, creating a public ledger of who owns what.

When tokens trade, the blockchain updates instantly, no waiting for signatures or middlemen. The bricks and mortar stay where they are, but the proof of ownership moves online, as easily as sending an email.

THE WEEK IN BRIEF

Image Source: Profit Pakistan

The Brief: Dubai-based Fasset has acquired DAO PropTech, Pakistan’s largest tokenized property platform, adding 80,000 users and $150 million of tokenized projects to its network. The merger aims to build a Shariah-compliant global RWA engine across Asia and the Middle East.

The Details:

DAO PropTech’s model proved that $25 micro-tickets can fund real projects from rental units to developments.

Fasset’s regulatory reach spans UAE, Malaysia, Indonesia, and the EU, offering a bridge from emerging to mature markets.

The deal integrates DAO PropTech’s multi-chain engine with Fasset’s “Own” Layer-2, creating infrastructure for cross-border property tokens.

Returns are claimed to come from rental income and project profits, historically 5–8 percent in Pakistan’s market, but global appetite is untested.

What This Means: Fasset is turning a local proof-of-concept into a regional experiment in inclusive ownership. The outcome will show whether small-ticket investors can plug into global RWA pipelines without losing regulatory protection.

Image Source: TechBullion

The Brief: U.S.-based DigiShares and Switzerland’s BrickMark have formed a transatlantic alliance to distribute institutional-grade property tokens across both regions. The partnership connects SEC-compliant infrastructure with EU-structured real-estate assets.

The Details:

BrickMark brings €210 million in tokenized real estate and 45,000 investors. DigiShares adds transfer-agent services and ATS connectivity.

The goal: cross-list U.S. and EU assets so accredited investors on either side can buy into the other’s markets.

Tokens will represent fund or property shares paying steady income, similar to private REITs.

What This Means: This is a credible blueprint for compliant cross-border trading of tokenized real estate. It moves the idea from pilot projects to institutional plumbing, but liquidity must follow filings before it becomes real market access.

Image Source: Desun

The Brief: Desun Real Estate Group has acquired 15 percent of Going Securities, a licensed Hong Kong brokerage and Web3 Association member. The move positions Desun to tokenize its property portfolio once regulators approve an expanded license.

The Details:

The stake gives Desun indirect access to SFC-regulated brokerage permissions.

A clause allows Desun to unwind the deal if the virtual-asset license is denied, signaling high regulatory dependency.

Desun plans to tokenize undervalued or illiquid assets it manages, seeking liquidity through digital markets.

What This Means: Desun’s bet is a hedge on Hong Kong’s regulatory direction. If the SFC proceeds, real estate tokenization could gain a local corporate backer; if not, it reveals how fragile the region’s Web3 momentum still is.

Image Source: CoinTrust

The Brief: Ahmedabad-based Landbitt has launched what it calls India’s first land-tokenization platform, letting users buy small digital shares of verified plots. Each token links to an SPV holding the actual land, recorded on blockchain.

The Details:

Landbitt targets retail investors priced out of property, promising entry with only a few thousand rupees.

The platform verifies titles, forms SPVs, and issues tokens representing equity in each land parcel.

India lacks clear rules on tokenized property; legality rests on private-placement structures that avoid public-offer status.

What This Means: A bold step into an unregulated zone. Landbitt could democratize land investment for small savers, or face quick regulatory pushback if authorities treat these tokens as unregistered securities. This could be India’s live stress-test of tokenized ownership.

BRIEF X SIGNALS

🔗 @RentaNetwork - Tokinvest partners with $2B API Global to tokenize real estate, enabling fractional access without banks or intermediaries. For saver-investors, this opens premium properties from low minimums with on-chain liquidity and transparency, a direct boost to access in a market projected to hit $4T by 2035.

🔗 @BTCLandlords - Landbitt launches India’s first blockchain-based real estate tokenization platform, alongside Mumbai’s $566B tokenization drive and ADREC-ADRES going on-chain. This signals compliant regional expansion, lowering barriers to fractional ownership in emerging markets with verified land parcels and regulatory alignment.

🔗 @TakingStockLive - Real-world asset tokenization exceeds $35B across blockchains, with Injective co-founder discussing onchain finance future. For investors, this validates growing market maturity, offering potential yields from tokenized properties while highlighting institutional adoption for safer, compliant entry points.

🔗 @landinvestio - Tokenization addresses real estate’s structural access gaps with full U.S. regulatory compliance (Reg D/S), audited ownership, and quarterly dividends via $PRPTY security tokens.

^

See you in the next brief,

Tatenda